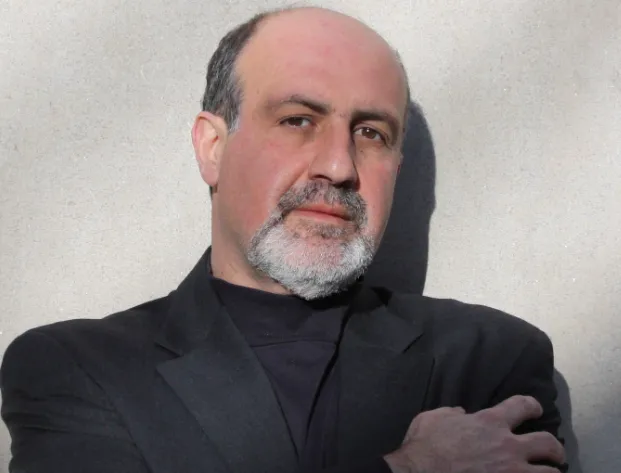

Nassim Taleb’s net worth is estimated to be around $5 million. He is a renowned essayist, scholar, and statistician. Nassim Nicholas Taleb has gained widespread recognition for his risk management and probability work. His best-selling book, “The Black Swan,” catapulted him to fame, delving into the impact of highly improbable events. Taleb’s multifaceted career includes hedge fund management, trading, and a scholarly tenure at New York University’s Polytechnic School of Engineering. His ideas on uncertainty and randomness have influenced fields beyond finance, medicine, politics, and philosophy. A prolific author and public intellectual, Taleb continues contributing to discussions on global finance and risk in academic circles and the public domain.

Nassim Taleb’s Bio

| Category | Details |

|---|---|

| Full Name | Nassim Nicholas Taleb |

| Birth Date | September 12, 1960 |

| Nationality | Lebanese-American |

| Education | – University of Paris (BS, MS) – Wharton School of the University of Pennsylvania (MBA) – University of Paris (Dauphine) (PhD) |

| Notable Works | – “The Black Swan” – “Antifragile” |

| Career Highlights | – Former option trader – Risk analyst – Distinguished Professor of Risk Engineering at NYU Tandon School of Engineering – Co-editor-in-chief of the academic journal “Risk and Decision Analysis” |

| Awards | – Bruno Leoni Award – Wolfram Innovator Award |

| Key Concepts | – Black Swan theory – Antifragility |

| Influential Book | “The Black Swan” (2007) |

| Views on Risk | Advocates a “black swan robust” society and proposes “antifragility” in systems |

Nassim Taleb’s Path To Prominence

Nassim Taleb’s journey to fame is a story of intellect and insight. His path to prominence showcases how education, passion, and unique career choices can lead to remarkable success. Taleb’s blend of knowledge in finance, mathematics, and philosophy has positioned him as a thought leader. This has significantly impacted his net worth, making his story inspiring to many.

Early Life And Education:

Nassim Nicholas Taleb was born in 1960 in Lebanon. He grew up during a time of political turbulence, which shaped his perspectives on uncertainty and risk. Taleb moved to France for higher education, earning a bachelor’s and master’s degree in science from the University of Paris. Later, he obtained an MBA from the Wharton School at the University of Pennsylvania and holds a PhD in Management Science. His academic journey laid the groundwork for his future achievements.

Career Breakthroughs:

After completing his education, Taleb entered the finance world, working in trading and risk management. His experiences in these roles were pivotal, inspiring his later work as an author and scholar. Taleb’s career breakthrough came with the publication of “Fooled by Randomness” in 2001, exploring the impact of chance in life and markets. This book gained international acclaim, establishing Taleb as a leading thinker. Following this, his book “The Black Swan” in 2007 further solidified his status, delving into the extreme impact of rare and unpredictable events. These publications contributed greatly to Taleb’s prominence and net worth.

Throughout his career, Taleb has held positions at major financial institutions and been a professor at several universities. His work spans probability, risk management, and statistical science. Taleb’s unique insights into the complexities of the financial world have made him a respected figure. His contributions to understanding risk and uncertainty are invaluable.

Black Swan Theory And Financial Success

Imagine a world where rare and unexpected events change everything. This is what Nassim Taleb’s Black Swan Theory is all about. Taleb’s ideas have made him famous and helped him build his wealth. Let’s explore how black swans can create financial success or failure.

Concept Of Black Swan Events:

Black Swan events are surprising and major, beyond what we normally expect. These events have three main features:

- Unpredictable: They are still waiting to see them coming.

- Massive Impact: They change the game.

- Explained After: People say it was obvious later.

Impact On Financial Markets:

Financial markets hate surprises, but black swans are full of them. When a black swan hits, markets can crash or soar, depending on the event. Taleb’s net worth grew as he understood this, making systems that win when chaos happens. This has made him a legend in finance.

| Year | Event | Market Impact |

| 2008 | Financial Crisis | Big Crash |

| 2020 | Pandemic | Massive Volatility |

Books And Publications

Nassim Taleb is a well-known author whose books discuss randomness, probability, and uncertainty. These topics are complex, yet Taleb makes them easy to understand. His writings have changed how people see the world.

Bestselling Titles:

Taleb has written several important books. Each one has made an impact.

- The Black Swan: This book discusses rare and unpredictable events and shows how they can have a huge effect.

- Antifragile: Here, Taleb introduces a new way of thinking, talking about things that gain from disorder.

- Fooled by Randomness: This book examines luck and explains how it plays a big part in our lives.

- Skin in the Game: Taleb argues that risk-taking is essential, saying you must have something to lose.

Influence On Readers And Critics:

Taleb’s books have touched many people and sparked debates. Readers and critics alike find his ideas powerful.

| Book Title | Impact |

| The Black Swan | Changed how we see risk and randomness. |

| Antifragile | Introduced a new way to thrive in chaos. |

| Fooled by Randomness | Revealed the role of luck in success. |

| Skin in the Game | Emphasized the importance of risk-taking. |

Each book has its message, yet all share a common theme, challenging us to think differently. Taleb’s work encourages us to question what we know.

Business Ventures And Investments

Nassim Taleb is more than just a writer. He is also a skilled investor and businessman. His smart business and investment choices have grown his wealth. Many want to know how he made his money.

Entrepreneurial Pursuits:

Taleb’s journey in business is fascinating. He started several ventures over the years, each adding to his net worth. Taleb’s ventures are diverse, including:

- Trading firms: He worked with derivatives and hedge funds.

- Advisory roles: Companies sought his expert risk advice.

- Writing: His books sold millions, earning him royalties.

These steps show his love for taking calculated risks. This approach has paid off, increasing his wealth.

Investment Strategies:

Taleb’s investment strategies are unique, focusing on probability and uncertainty. His main strategies include:

- Investing in options that benefit from market volatility.

- Avoiding losses by not following standard predictions.

- Keeping a diverse investment portfolio to reduce risk.

Taleb’s methods protect and grow his investments. He is ready for unexpected market changes.

| Strategy | Focus | Outcome |

| Options Trading | Market Volatility | High Returns |

| Non-Predictive Approach | Risk Avoidance | Stable Investments |

| Diverse Portfolio | Risk Management | Protected Wealth |

Taleb’s success comes from these smart moves, turning market chaos into opportunities. His net worth continues to grow because of this.

Speaking Engagements And Public Appearances

Nassim Nicholas Taleb stands as a towering figure in finance, risk management, and philosophical insight. His thought-provoking ideas and profound understanding of probability and uncertainty have garnered him a substantial net worth. Much of this net worth stems from his highly sought-after speaking engagements and public appearances.

Taleb’s expertise is not confined to the pages of his bestselling books. He takes the stage at various events to share his knowledge and experiences, commanding hefty fees contributing to his impressive net worth. Let’s explore the events where Taleb’s voice resonates the most.

Keynote Speeches:

As a keynote speaker, Taleb captivates audiences with his insightful perspectives, often focusing on key concepts like Black Swan events and antifragility. Organizations worldwide pay top dollar for the privilege of his wisdom at their events. Below are the types of events where Taleb is a regular:

- Global Economic Forums

- Corporate Leadership Gatherings

- University Commencements

- Financial Industry Summits

Seminars And Conferences:

Beyond keynote speeches, Taleb is a staple in the seminar and conference circuit. His sessions often offer deeper dives into complex topics, engaging with other industry leaders and thinkers to create a rich exchange of ideas. Attendees leave with a new appreciation for uncertainty and risk, significantly adding to their net worth. Examples include:

| Event Type | Topics Covered | Average Attendance |

| Investment Seminars | Market Risk, Decision Making | 500+ |

| Academic Conferences | Statistics, Risk Analysis | 300+ |

| Technology Conferences | Future Trends, Innovation | 1000+ |

Academic Contributions And Teaching Roles

Nassim Taleb is not just known for his financial insights. His academic contributions and teaching roles have also made a significant impact. Let’s delve into his research and teaching philosophy.

Research Focus:

Nassim Taleb’s research revolves around probability, uncertainty, and randomness. He explores how these elements affect various fields, especially finance and economics. His work on “black swan events”—rare and unpredictable occurrences—is widely acclaimed. Taleb’s research aims to make systems more robust and less vulnerable to these unpredictable events.

Teaching Philosophy:

Taleb believes in practical learning and understanding theories through real-life applications. His teaching method focuses on critical thinking and questioning assumptions, encouraging students to embrace uncertainty and use it to make better decisions. Key aspects of his teaching include:

- Interactive Learning: Engages students in discussions, making lessons dynamic.

- Real-World Examples: Uses practical examples to explain complex theories.

- Encourage Curiosity: Motivates students to ask questions and explore beyond textbooks.

Nassim Taleb’s blend of research and teaching has enriched both fields, inspiring many to think differently about uncertainty and randomness.

Media Presence And Social Commentary

Nassim Taleb, a well-known figure in finance, also shines through his media presence. His sharp insights on probability and risk resonate across various platforms, and his commentary on social and economic issues garners significant attention. This spotlight amplifies his net worth, not just in dollars but in influence.

Television And Podcast Appearances:

Taleb’s expertise has landed him on numerous TV shows and podcasts, often discussing market dynamics, personal finance, and risk management. His appearances contribute to his status as a thought leader in his field. Here’s a snapshot of his media footprint:

- CNBC: Discussing market trends

- Bloomberg: Sharing economic forecasts

- Joe Rogan Experience: Deep diving into risk philosophy

Social Media Influence:

With a robust social media following, Taleb’s tweets and posts often go viral. He uses platforms like Twitter to share his opinions on current affairs, sparking discussions and debates. His social media stats are impressive:

| Platform | Followers | Engagement |

| Over 700K | High | |

| Tens of thousands | Moderate |

Taleb’s online presence is a testament to his influence, affecting his net worth beyond numbers. It cements his role as a key player in public discourse on risk and uncertainty.

Estimating Nassim Taleb’s Net Worth

Today, we will explore how to estimate Nassim Taleb’s Net Worth. The famous author and former trader has intrigued many. But how rich is he really? Let’s explore.

Sources Of Income:

Nassim Taleb has several income streams, including:

- Book Sales: Taleb has written popular books that sell worldwide.

- Speaking Engagements: He gets paid to speak at events.

- Trading: Taleb made money in trading before writing.

- Consulting: Companies pay him for advice.

Net Worth Calculations:

Calculating Taleb’s net worth involves looking at assets and earnings. Below is an estimation:

| Source | Estimated Earnings |

| Book Sales | $5 million |

| Speaking Engagements | $2 million |

| Trading | $10 million |

| Consulting | $3 million |

Taleb’s net worth might be around $20 million.

Philanthropy And Personal Investments

Exploring the world of finance, Nassim Taleb stands tall as a thought leader. His theories on randomness and risk have influenced markets and his approach to wealth. This section delves into Taleb’s generous spirit and savvy investment choices.

Charitable Giving:

Nassim Taleb is not just about theories and trading. His heart beats for giving back, with philanthropy efforts as strategic as his trading. He focuses on causes that align with his principles of antifragility and randomness:

- Education: Funds scholarships for promising students.

- Research: Supports research on risk management and probability.

- Environment: Contributes to conservation efforts.

Personal Asset Allocation:

Taleb’s portfolio mirrors his beliefs in financial security and uncertainty. He diversifies to withstand market volatility, including a mix of:

| Asset Type | Allocation Percentage |

| Safe Bonds | 50% |

| Equities | 20% |

| Real Estate | 10% |

| Options Trading | 10% |

| Commodities | 10% |

This distribution reflects Taleb’s strategy to thrive in disorder, preparing for the unpredictable with a balanced approach. His investments show his commitment to surviving and flourishing in any financial climate.

Taleb’s Influence On Modern Risk Management:

Nassim Nicholas Taleb, an influential thinker and author, reshaped how we approach uncertainty. His work on risk, probability, and randomness challenges conventional wisdom and impacts how corporations manage risk. His net worth reflects the value of his contributions.

Adoption In Corporate Strategies:

Companies worldwide integrate Taleb’s ideas into their risk management frameworks. His concepts, such as “Black Swan” events, encourage robustness and prepare for the unpredictable. Corporations now stress-test against extreme scenarios, emphasizing resilience, diverse investments, and precautionary principles.

Legacy In Financial Theory:

Taleb’s theories significantly influence financial models. His books are essential for finance professionals, shaping how experts think about markets and volatility. His work on “antifragility” is particularly notable, arguing for systems that gain from disorder. This idea has become central in the development of financial theory.

| Concept | Impact |

| Black Swan | New risk assessment methods. |

| Antifragility | Frameworks for growth in volatility. |

| Optionality | Value of flexibility highlighted. |

Future Prospects And Projects

Nassim Taleb’s influence in finance, probability, and risk is undeniable. His books have sparked discussions and debates among academics, traders, and the general public. Taleb’s prospects and projects will further shape our understanding of uncertainty and randomness.

Upcoming Books:

Taleb’s literary journey continues as he teases the release of new thought-provoking titles. Fans and critics eagerly anticipate his next work, promising deeper dives into risk management and philosophy. Readers can expect his trademark blend of scholarly insight and practical advice.

New Business Endeavors:

Taleb’s business acumen shines through his new ventures, and he is looking to integrate his theories into practical tools for risk assessment. These tools will likely influence various industries, from finance to healthcare, driven by his unique approach to probability and statistics.

Reflections On Wealth And Success

Nassim Nicholas Taleb is a prominent figure, with insights on wealth and success resonating with many. Taleb, a former trader turned scholar and essayist, amassed significant wealth. His net worth reflects his financial theories and risk management expertise.

Taleb’s Personal Views:

Taleb often discusses the role of randomness in success, believing luck plays a major part in acquiring wealth. His book, “Fooled by Randomness,” delves into this, suggesting many ignore the impact of random events, often attributing success to skills alone. For Taleb, success is more than monetary gains, valuing intellectual freedom highly. He prefers to focus on antifragility, thriving from disorder, with an approach to wealth that is unconventional yet thought-provoking.

Advice For Aspiring Entrepreneurs:

Taleb offers practical advice for entrepreneurs, stressing the importance of skin in the game, meaning having a personal stake in their ventures. He believes this aligns with integrity and accountability:

- Take risks, but understand them well.

- Learn from failures; they are valuable lessons.

- Focus on resilience; build a robust business.

- Embrace uncertainty; it can lead to opportunity.

Entrepreneurs should also diversify their investments, not putting all eggs in one basket, reducing vulnerability to single points of failure. Taleb’s guidance inspires many to pursue their goals with tenacity and wisdom.

Social Media Profile

| PLATFORM | LINKS |

| Wikipedia | Click here |

| Instragram | Click here |

| You Tube | Click here |

Conclusion

Nassim Taleb’s financial journey is as dynamic as his market theories. His net worth reflects a lifetime of scholarly pursuits and practical applications. Understanding his wealth offers a glimpse into the success achievable through risk intelligence and robust strategies. Taleb’s story inspires financial thinkers and risk-takers alike, proving that financial growth is within reach with knowledge and courage.

View this post on Instagram

>>>Also Read About: Billy Carson Wife And Biography